Environmental Sustainability Dashboard: Sustainability Monitoring Solution

The growing importance of sustainability as a business opportunity and new regulatory obligations for companies are making non-financial reporting increasingly complex for many companies. To simplify the processes: from needs analysis to monitoring and analysis of ESG indicators, we have developed the Environmental Sustainability Dashboard, a consulting solution combined with a monitoring tool.

Is the sustainability report also your responsibility?

The obligation of non-financial reporting was introduced by the Corporate Sustainability Reporting Directive (CSRD), as an evolution of the previous Non-Financial Reporting Directive (NFRD). The regulation was issued in 2022 and from 2024 many companies will have to present annual sustainability reports, drawn up according to the European Sustainability Reporting Standards, the so-called ESRS. Sustainability concerns the Environmental, Social and Governance (ESG) sectors.

The non-financial reporting requirement already applies to European companies with specific requirements. In the following years it will be systematically expanded according to the following schedule:

- From 2024, so-called public interest enterprises with a turnover exceeding 50 million euros and employing more than 500 people,

- From 2025 onwards, all large companies or parent companies of large groups meet at least 2 of the following criteria: revenues min. 50 million euros, more than 250 employees, balance sheet total min. 25 million euros,

- from 2026 onwards, medium and small listed companies that meet at least 2 of the following criteria: balance sheet total min. 5 million euros and revenues min. 10 million euros for small enterprises or balance sheet total min. 25 million euros and revenues min. 50 million euros for medium-sized enterprises.

In the environmental field, ESG reports will include, among other things, data on greenhouse gas emissions, how and to what extent the company is impacting the environment and the state of implementation of a circular economy.

Prepare for non-financial reporting with the Environmental Sustainability Dashboard

The Environmental Sustainability Dashboard is a consulting solution that supports you in preparing your company for mandatory non-financial reporting. Our solution consists of a needs analysis, definition of the reporting content according to CSRD requirements, supported by a web platform for the evaluation of the related Key Performance Indicators (KPI).

Our consulting solution supports you for:

- sustainability context analysis of your company

- definition of the objectives to be achieved

- identification of KPIs needed to measure performance

- Identifying relevant and available inputs in your business, along with appropriate procedures to collect them efficiently

- collection of data needed for the sustainability report in a digital tool

- measuring environmental KPIs for non-financial reporting.

Furthermore:

- Identifying your company’s data that impacts your ESG assessment

- Monitoring your company’s environmental KPIs

- more time to implement measures that improve sustainability performance and strengthen your market position

- compliance with non-financial reporting obligations and reduction of reputational risk

- robust data to meet the needs of your company’s investors and stakeholders.

Environmental Sustainability Dashboard: Comprehensive ESG Sustainability Consulting

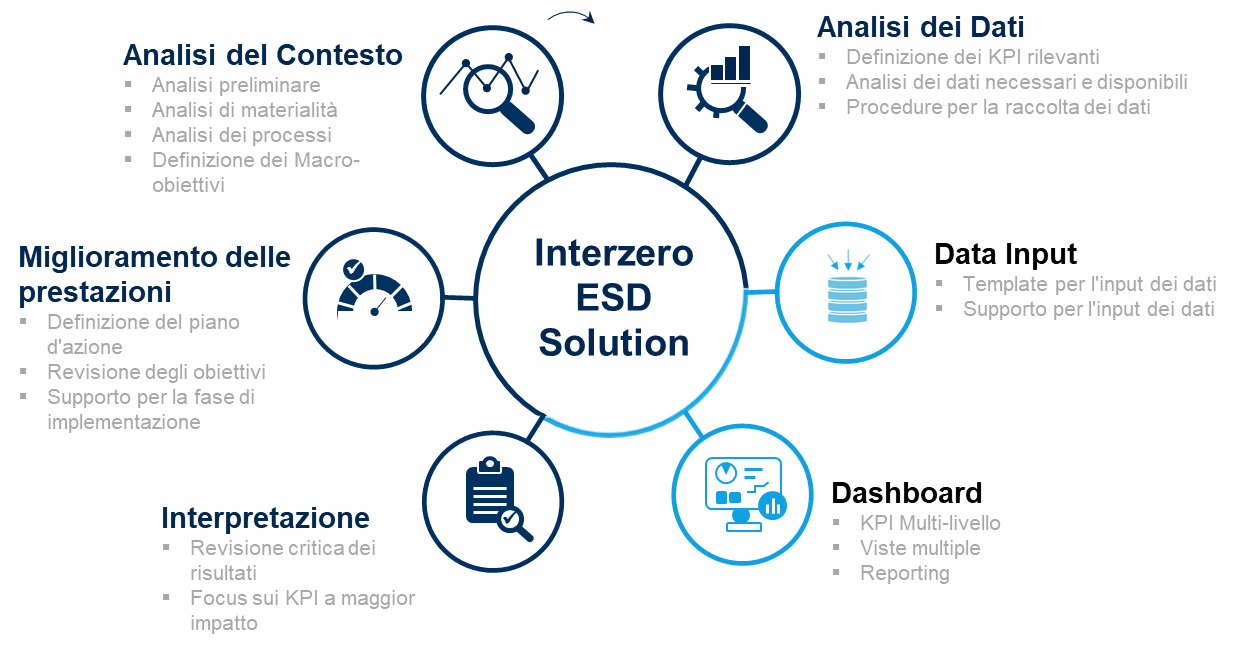

A key element of the Environmental Sustainability Dashboard is the advice on the process of identifying specific needs, preparing and aggregating data for non-financial reporting . Due to the multiplicity and dispersion of this information, analyzing the context, defining the necessary actions, selecting and collecting data can be time-consuming and lead to costly errors.

Interzero offers full support in understanding and implementing CSRD requirements, as well as consultancy in the drafting of non-financial reporting: defining the context to support you in data collection, critical review of the results and preparation of the final document. To meet the highest reporting standards, our solution consists of several carefully planned phases:

- Context analysis – preliminary study of the corporate context and business environment, to identify the “material” aspects

- Data analysis – support for the selection of environmental KPIs, input data, and collection

- Data Collection : Multi-level dashboard data entry to visualize results and reporting in compliance with CSRD. Customization options

- KPI Interpretation: Critical Review of Performance and Multidimensional Analysis of the Real Impact of the Company

- Improvement plan : identification of a corrective action plan, review of short, medium and long-term objectives

- Change process: support for the implementation of corrective actions

Calculation of ESG indicators in accordance with the CSRD

Your company’s ESG indicators are measured according to official international standards :

- Environmental Reporting Guidelines (GRI),

- Greenhouse Gas (GHG Protocol)

- CSRD compliant ESG KPIs.

The methodology used is compliant with the Corporate Sustainability Reporting Directive (CSRD) and the Sustainability Reporting Standards (ESRS).

Additionally, you can include custom KPIs.

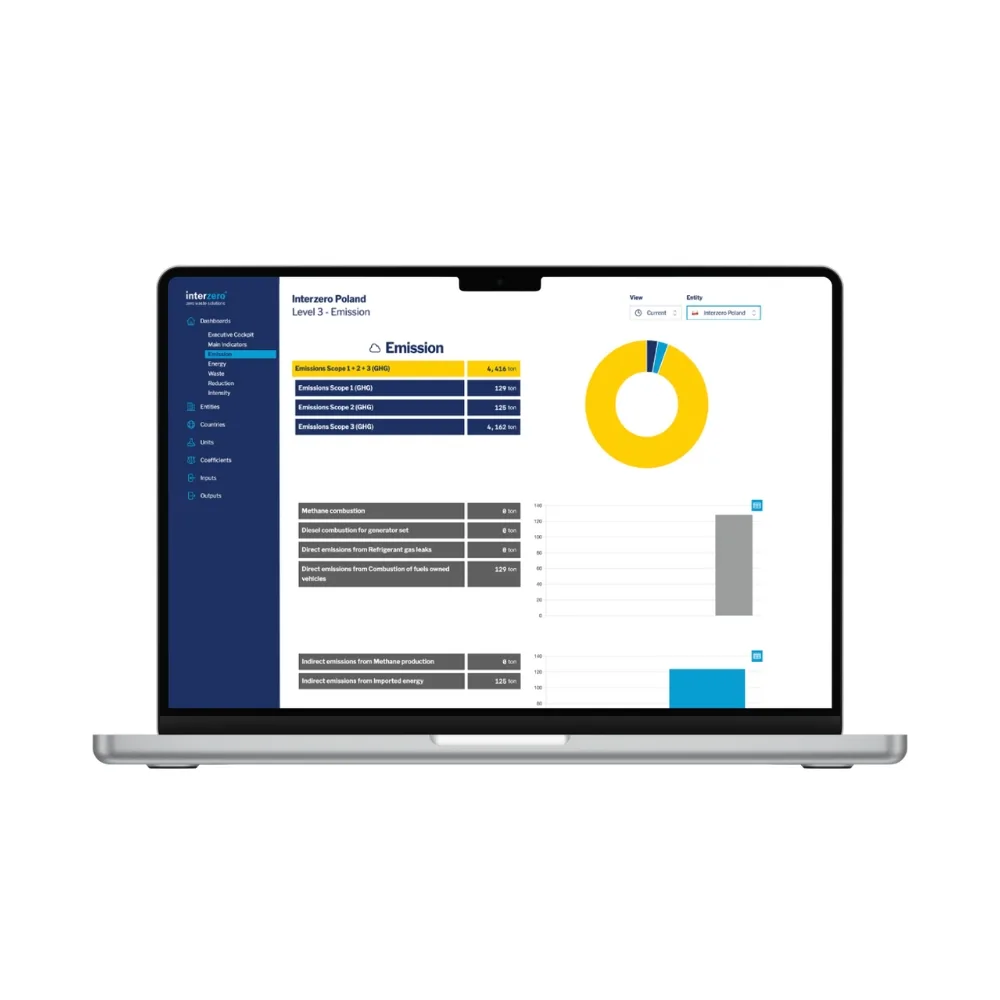

The Dashboard: A Digital Support for Data Monitoring

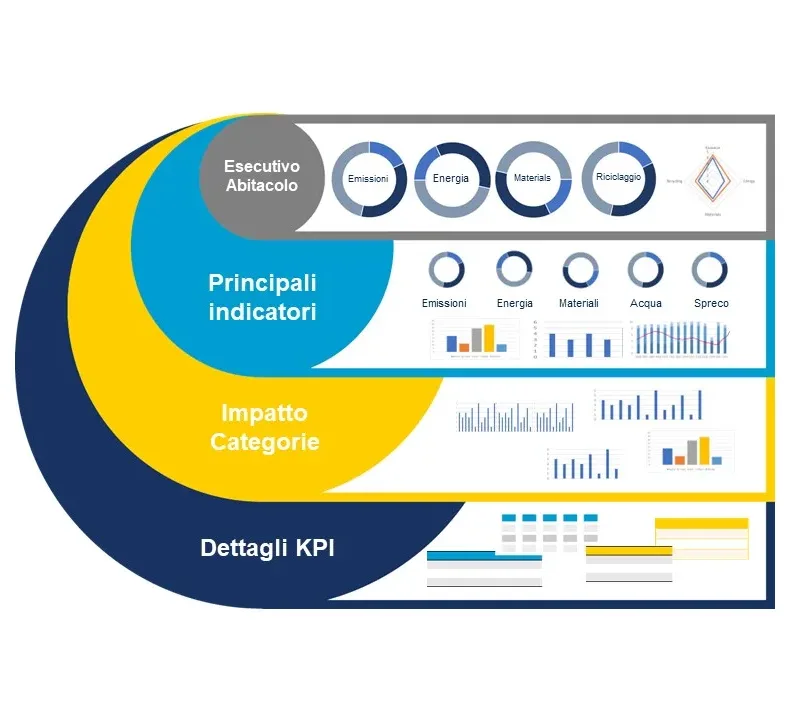

An integral part of our solution is the digital platform that allows you to track KPIs, monitor ESG factors and create reports for your company. It allows different and multi-level views.

Monitor your company's sustainability indicators

The ESD platform has multiple features that allow you to monitor sustainability KPIs. Structured visualizations with diagrams, graphs and tables show information in a simple but accurate way.

The data is presented in a clear graphical format, facilitating the analysis and critical review of environmental performance.

Create CSRD compliant reporting

From the ESD platform you can generate ready-to-use, CSRD-compliant KPI reports.

Reports can be easily customized , to better focus on your real needs.

Grow your business with Interzero's Environmental Sustainability Dashboard

Interzero’s solution allows you to make informed decisions. Our experts will guide you through the analysis process, facilitating the implementation of measures to improve your company’s sustainability performance.

What are the benefits of choosing the Environmental Sustainability Dashboard?

- Reducing the impact on the environment.

- Meeting increasingly stringent regulatory and ESG requirements

- Competitiveness. More and more consumers/shoppers are making environmentally friendly purchasing decisions.

- Green communication: it also improves your reputation on the market.

- Calculation methodology: based on International Standards: GRI – GHG – CED.

Why Interzero?

We are the reference partner for the circular economy, serving companies in all sectors. For over 30 years, we have supported companies in all sustainability issues at an international level.

Our experience and commitment to sustainability make us a trusted partner for organizations looking to improve their environmental performance. Our most valuable asset? Our team of expert consultants. Starting from ESG objectives, we focus on corporate sustainability goals, providing solutions that improve ESG indicators and overall performance.

We have a consolidated expertise in corporate impact assessment using international standardized methodologies. As part of our consultancy, we support clients in planning and implementing sustainable initiatives, providing innovative tools that automate various processes and minimize the risk of errors.

Non-financial reporting requirements: the most frequently asked questions

Is non-financial reporting a new requirement for your company? Find answers to common questions about ESG factors.

ESG (Environmental, Social, Governance) is a set of indicators relating to environmental, social responsibility and governance issues of a company. They form the basis for ratings and non-financial assessments of companies, countries and other organizations (e.g. NGOs).

Individual indicators and a company’s ESG rating allow us to verify whether and to what extent an organization is committed to sustainability, implementing socially responsible business practices and bringing benefits (mainly non-financial) to all its stakeholders. The analysis of ESG strategy is important in the assessment of corporate risks, carried out, among others, in M&A processes, by investors and, increasingly, by potential counterparties of a company.

It is an annual non-financial report that provides information on a company’s activities in 3 areas: environmental, social and governance. A properly structured ESG report should be based on the guidelines contained in a series of regulatory documents (national, European and international) including:

- Non-Financial Disclosure Directive (NFRD/CSRD)

- Corporate Sustainability Reporting Directive (CSRD)

- Accounting Act implementing the Directive on disclosure of non-financial information

- Financial Services Sustainability Disclosure Regulation (SFDR)

- EU Taxonomy Regulation

- Recommendations of the Task Force on Climate-related Financial Disclosures (TCFD).

The ESG reporting obligation came into force on 1 January 2024. From this date, many companies must submit mandatory non-financial reports annually. In subsequent years, the ESG reporting obligation will be extended to increasingly smaller entities operating in the EU.

The non-financial reporting requirement already applies to European companies with specific requirements. In the following years it will be systematically expanded according to the following schedule:

- From 2024, so-called public interest enterprises with a turnover exceeding 50 million euros and employing more than 500 people,

- From 2025 onwards, all large companies or parent companies of large groups meet at least 2 of the following criteria: revenues min. 50 million euros, more than 250 employees, balance sheet total min. 25 million euros,

- from 2026 onwards, medium and small listed companies that meet at least 2 of the following criteria: balance sheet total min. 5 million euros and revenues min. 10 million euros for small enterprises or balance sheet total min. 25 million euros and revenues min. 50 million euros for medium-sized enterprises.

ESG indicators (also known as ESG factors) can be divided into 3 main areas: environmental, social and corporate governance.

Examples of environmental ESG factors include:

- Climate change mitigation

- Adaptation to climate change

- Protection and sustainable use of inland and marine waters

- Adopting a circular economy

- Pollution prevention and control

- Protection and restoration of biodiversity.

Examples of social ESG factors include:

- Working conditions

- Health and safety at work,

- Inclusivity and diversity in the workplace

- Development and training opportunities

- Respect for human rights

- Community Relations

- The company’s impact on consumers and end users.

Examples of ESG factors relating to governance include:

- Responsible Corporate Culture and Conduct

- Corporate influence and lobbying activities

- Relations with suppliers and business partners

- Data privacy and security.